Chapter

Let’s jump right in; I know you are keen to get into the nuts and bolts.

Equity!

We hear it spoken about by everybody. The media, your mates around the BBQ, your wife’s best friend, your accountant and every investment educator worth their salt and some that aren’t. They throw the term ‘equity’ around as if it’s this tangible thing that you can use to get rich just by saying the word.

But what is Equity?

Equity in its simplest form, when it relates to property, is the difference between what your property is valued and how much you still owe against the property.

If your property is valued at $1,000,000, and you still owe $500,000, then you have $500,000 in equity, right?

Simple.

Well, not so fast! There is a little more to it than that.

That full $500,000 of equity cannot all be used to buy another property, for example. It’s also not $500,000 in cash that the bank will just give you.

Due to the bank’s aversion to risk, they like to keep a safe buffer between what your property is worth and what they will allow you to borrow against it.

In the same way, as you cannot borrow 100% of a property; (you require a deposit) with equity, the bank requires they keep 20% of your property’s value as a safeguard against market fluctuations and the possibility that you don’t repay your loan, and they need to sell it to recover costs.

So, using the above figures of a $1,000,000 property, with a $500,000 loan, the bank would calculate 80% of $1,000,000, so $800,000, and then subtract what you still owe, in this case, $500,000. Leaving you with $300,000 in usable equity. Remember that term. Useable equity.

Simplified it’s:

$1,000,000 (Value) X 0.8 = 80% of your properties value or $800,000.

$800,000 – (minus) $500,000 (what you still owe) = $300,000 in Usable Equity

Now, if you are ok with a higher level of risk, then the bank will allow you to borrow up to 90% of the value of your property (It’s the same calculation but with .9 instead of .8) though they will charge you ‘Lenders Mortgage Insurance’ (LMI). This is insurance that you pay (usually the bank adds the cost of LMI to your loan), and it protects the bank if you default. It’s not there to protect you. That sounds like a bad deal, right? Well, maybe. We’ll discuss this more later.

As a rule, I try to stay at 80% LVR or below. If you are in a real hurry to build your portfolio and have zero worries about the higher risk involved, then a 90% LVR may be an acceptable option. But for me, with a family and kids to consider, 80% LVR is where I’m comfortable.

So, here we are, with $300,000 of usable equity. But how does that equity become something I can use? Does the bank just give me $300k?

So NOW we enter the crux of the Equity Advantage:

The bank allows you to borrow that equity/cash money from them. So, in this case, you will take out a loan of $300,000, and then, they will give you $300,000 in cash. Now, your equity is real. It now exists. It is now tangible.

As an investor, what is the best way to borrow that equity? Should we take it in one lump sum? Should we release it as a principal and interest loan or an interest-only loan?

Should it be added to your Owner Occupier home loan?

And how do you use this new cash that the bank has just lent you to buy a new property?

Do we buy a $300,000 property outright?

The answer is very simple, though thousands of investors get it wrong every year and it costs them dearly. Getting this right will ensure you can continue to invest and will protect you as an investor. Low risk, is where I prefer to operate from when investing.

It’s as simple as A, B, & C.

In fact that’s what I call it - A, B, & C.

Lets go through a scenario of a Self-Employed individual wanting to use the ABC Equity Advantage.

Step A is to Refinance your existing home.

Step B is to Release your equity as a separate loan with its own offset account.

Step C is to Get pre-approval for the amount you wish to use to purchase an investment property.

Now, let’s unpack the A, B, & C in a little more detail.

Self-Employed example of using the A,B,&C Equity Advantage:

Step A: You are about to release $300,000 in equity from your ‘Own Home’, which you will use as deposits to help buy two more properties. In this scenario the applicant wants to purchase two properties so its smarter to release enough equity for the second property at the same time as the first.

You will refinance your existing home with a lender that will lend to self-employed applicants with specific business requirements (Ensuring the bank’s policy matches your income requirements is essential).

You will ensure that the lender has a ‘cash out’ policy (cash out is Equity in the finance industry) that will allow you to release $300,000 for investment purposes.

Some lenders have limitations on how much cash out (equity) they will allow you to release.

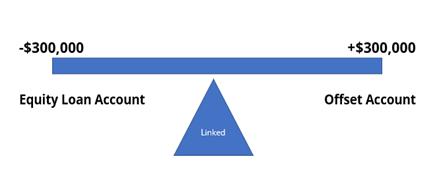

Step B: The cash out will be released as its own 5-year Variable Interest Only loan with an offset.

We do this so that once your equity is released, you can place the $300,000 in the offset account, and as your loan is IO, you won’t make any repayments.

WHAT NO REPAYMENTS AT ALL?

None at all while those two amounts are balanced. If you spend $1 of your $300,000, you begin to pay interest and make repayments on $1.

No Payment Interest Only Loan Structure

You could effectively have $300,000 in an account while you look for the ‘right’ property for 5 years and never have to pay a cent in repayments. And if you don’t want to keep the ‘cash out’ after the 5 years IO loan limit, then you can simply ask the bank to close out your account. No harm, no foul. This is truly one of the best benefits of equity when it is set up correctly.

Step C: Pre-approval for your purchase loan amount. Easy.

And the good news is that A, B, & C can all be done at the same time. So, you only have to gather one lot of documents. You get three applications for the effort of one.

But what do we use the equity for?

The equity is to be used for your deposits!

Depending on the price of the properties you are looking to buy, your equity should be rationed and stretched as far as possible. So, don’t go putting down a $300,000 deposit on a million-dollar property.

You could, but that’s all your equity gone in one go.

If your risk profile and buying rules have indicated that you want to buy property in the $650,000 price range, then you would split your equity up into as many deposits as possible and as many purchases as your borrowing capacity will allow.

That’s why you are much better off using a broker that can calculate your borrowing capacity for purchases 1, 2 and 3. It’s vital- you need to know you will have the best chance of being approved for all your intended purchases when you release your equity. There is no point in releasing $300,000 in equity if all you can afford is one investment property.

In the above scenario, I would try to squeeze three $650,000 properties out of that amount of equity.

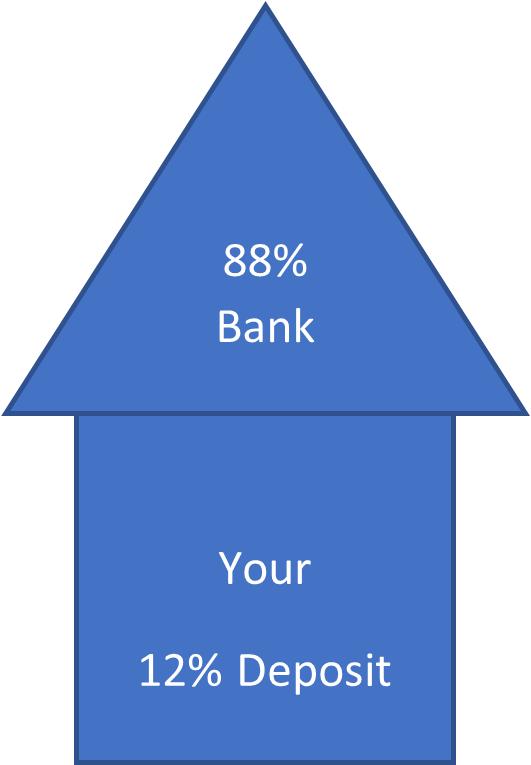

The breakdown is as follows. A 12% deposit for a $650,000 property is $78,000.

Why a 12% deposit you ask?

Because it’s the minimum amount you need as an investor to use 99% of all banks and lenders.

The majority of the banks and non-banks in Australia have a 90% LVR threshold for all investment purchases. That’s their policy, and you can’t get around it. Yes, there are some lenders that will go to 95%, but the LMI fees skyrocket once your LVR hits 90% and over. So a 12% deposit is the sweet spot of a manageable LMI fee and maximising your deposit.

A 12% deposit is because we are above the 80% LVR range that banks like, which means they will slug you with Lenders Mortgage Insurance. As mentioned before, the bank will add your LMI fee to your loan amount. So, let’s look at the figures for this scenario.

$650,000 X 0.12 = $78,000, which leaves a loan amount of $572,000.

This is 88% of the value of the $650,000 property. When the bank adds LMI onto your loan, as a rough guide it will be slightly less than 2% of the property’s value. So, when LMI is added to your loan at settlement, your LVR will sit just under the 90% threshold and therefore, still within bank policy. So, as an investor, start thinking of 12% deposits as the norm. Take 10% deposits out of your mindset.

So, $78,000 for a 12% deposit and then add $25,000 for stamp duty (for an existing property). Total of $103,000.

Same again for purchase two, and then for purchase three, you will be a little bit short, so you reduce your purchase limit for the third property. This way, you have purchased three properties very close to your target range and maximised your equity release of $300,000 by purchasing three properties from just one equity release.

In one year, you can go from owning one property to owning four. All with the help of using the Equity Advantage and it’s as simple as A, B, &C.

Your equity can also be used for any renovations that your property may need, any solicitor costs, buyers’ agents’ fees and anything that is investment related. It’s not advisable to use equity for personal purposes unless you have specifically split your equity for that purpose.

How much should my pre-approval be?

If your maximum Borrowing Capacity (BC) is $500,000, then that’s what we apply for. It’s much easier to change your loan to a lower amount than to increase it above what was pre-approved.

So, after a year of purchasing, you now have 4 properties and zero equity left. What do you do now?

Well, 4 properties could be all you require if they are good investment stock. If you have planned that you need 5 or 6 properties in your portfolio to retire or whatever your goal may be. Then you will need to wait for the market to create more equity through organic growth. Or you can create capital growth yourself by improving a property so that it achieves a higher valuation than when you bought it. The good thing is you have four properties to release equity from, so obtaining your last one or two deposits from equity should not be that hard.

The A, B, & C is the rinse and repeat process you can use for every purchase moving forward, so you don’t have to use your own hard-earned cash that you have already paid tax on.

Another reason why equity is your golden ticket and gives you such an advantage is that it is Tax-Free! You take it out, use it and don’t pay any tax on it. You pay a small amount in interest, but on the whole, it’s tax-free. This is why ‘I LOVE EQUITY’.

Did you also notice that we are actually borrowing 100% of the property’s value? You can’t borrow 100% as a traditional buyer, but having an existing property to release equity from, means you have now structured your way around that bank rule!!

See below for how to keep track of all your accounts.

Examples of how to structure and label your loan accounts for property investors.

- Example of how your loans and offsets should be structured for your first investment purchase

| Name of account | Loan Balance | | Name of Offset | Benefit |

| Owner Occupier Home loan | -$500,000 usually at P+I variable | Linked | O-Occ Offset- All spare income should be placed here. Even if it's just for 1-2 days. Including salary | Any funds in this offset will reduce the interest you pay on your O-Occ home loan |

| Equity Release Loan to be used for investment purposes | -$120,000 usually IO variable | Linked | Equity Release Offset +$120,000 | While these two amounts are equal no repayment will be required. When funds are used for investment purposes, such as your deposit then this interest becomes tax deductible also |

| Investment Property- A Loan | -$500,000 can be P+I or IO (variable or fixed) | | No offset is required as this is fully tax deductible | |

2. Example of how your loans and offset should be structured with two investment properties having released equity in two splits of $100,000 to be used for each deposit

| Name of Account | Loan Balance | | Name of Offset | Benefit |

| Owner Occupier Home loan | -$500,000 usually at P+I variable | Linked | O-Occ Offset- All spare income should be placed here. Even if it's just for 1-2 days. Including salary | Any funds in this offset will reduce the interest you pay on your O-Occ home loan |

| Equity Release Loan No.1 River St to be used for investment purposes | -$100,000 usually IO variable | Linked | Equity Release Offset No.1 +$100,000 | Same as example 1 |

| Equity Release Loan No.2 Wind Ave to be used for investment purposes | -$100,000 usually IO variable | Linked | Equity Release Offset No.2 +$100,000 | Same as example 1 |

| Investment Property No1. River St Loan | -$500,000 can be P+I or IO (variable or fixed) | | No offset is required as this is fully tax deductible | |

| Investment Property No2. Wind Ave Loan | -$500,000 can be P+I or IO (variable or fixed) | | No offset is required as this is fully tax deductible | |

Note: It is vital to name each account according to its purpose and the property it secures. Same with the offset accounts. This will allow you to distinguish your loans and your offset amounts easily and will make tax time a breeze as you will know exactly how much interest you have paid for each account for each property.

If you want to kick start your investment journey, then contact one of our team to discuss how you can make the most of your

Equity Advantage.

| Investment Tip # 8 - Who’s your best friend? EQUITY!! Your Tax-Free Bestie! |